Cost-Effectiveness Applications

Source:vignettes/cost-effectiveness-applications.Rmd

cost-effectiveness-applications.RmdIntroduction

Single cohort cost-effectiveness models are routinely used in the decision making of Health Technology Assessment (HTA) bodies, and are widely published in the scientific literature.(Espinosa et al. 2024; Enright et al. 2025; Do et al. 2021) Despite their utility, such models have been criticised as overly limited in scope, omitting important elements of value(Breslau et al. 2023; Shafrin et al. 2024)] and health equity(Avanceña and Prosser 2021). Anticipated pricing dynamics (life cycle drug pricing) are routinely ignored, meaning that the long run opportunity cost for drugs may be misrepresented,(Neumann et al. 2022) and single cohort modeling is criticized as not tailored to properly inform decision-making that will impact future cohorts of patients(Hoyle and Anderson 2010). Case studies have shown how dynamic (or ‘life cycle’) pricing and multi-cohort modeling can have substantial effects on reported Incremental Cost-Effectiveness Ratio (ICER) values and that, without accounting for these effects, ICERs are overstated and unrepresentative.(Schöttler et al. 2023; Whittington et al. 2025; Moreno and Ray 2016)

In a recent review, Puls et al listed four challenges in modeling life cycle drug pricing and offered some proposals.(Puls et al. 2024) Pricing changes before Loss of Exclusivity (LoE) events are ‘usually small’ but local pricing data can be informative, whereas after LoE, changes to pricing ‘should be informed by country-specific and historical estimates of average price reductions’, such as may be found in recent reviews.(Lin et al. 2025; Jofre-Bonet et al. 2025; Serra-Burriel et al. 2024; Laube et al. 2024) Following earlier recommendations by by Hoyle and Anderson, cost-effectiveness evaluations should include future incident cohorts in addition to the present, prevalent cohort,(Hoyle and Anderson 2010) though assumptions may need to be simplified to facilitate calculation. Reporting should include individual and multiple cohorts, assuming uniform or utilization-informed weightings.(Puls et al. 2024)

There are now a growing number of publications in which multi-cohort

cost-effectiveness evaluations with life cycle pricing have been

presented.(Puls et al. 2024; Schöttler et al.

2023; Whittington et al. 2025; Shafrin et al. 2024; Moreno and Ray

2016) The purpose of this R package is to provide a simple tool

to conduct calculations of present values that allow for dynamic pricing

and dynamic uptake. This vignette aims to illustrate how computations

may be performed. It is intended to be read after

vignette("dynamic-pricing") and

vignette("dynamic-uptake"). A mathematical framework

presented here formalizes what others have developed and applied,(Hoyle and Anderson 2010; Shafrin et al. 2024)

and provides the technical basis of the calculations within the

package.

Mathematical framework

Let us partition time as follows. Suppose indexes the time at which the patient begins treatment (with either the new intervention of Standard of Care, SoC), where is the time horizon of the decision-maker. Suppose indexes time since initiating treatment.

This can be illustrated through an example. Suppose then we are considering a cashflow in timestep 3. This will comprise:

- patients who are in the third timestep of treatment that began in timestep 1, ;

- patients who are in the second timestep of treatment that began in timestep 2, ; and

- patients who are in the first timestep of treatment that began in timestep 3, .

In general, , and we are interested in .

The Present Value of a cashflow for the patients who began treatment at time and who are in their th timestep of treatment is as follows

where is the risk-free discount rate per timestep, and is the cashflow amount in today’s money, and is the nominal amount of the cashflow at the time it is incurred.

The total present value is therefore the sum over all and within the time horizon , namely:

The dynamicpv::dynpv() function operationalizes this

calculation with arguments:

-

payoffs -

uptakes -

horizon, defaulting to the length ofpayoffs -

prices, where -

discrate -

tzero, defaulting to zero

The tzero argument is a time offset useful to be able to

calculate present values into the future, which can be performed for

single cohorts by dynamicpv::futurepv().

Assumptions

Before we start, we need to outline our assumptions. These concern:

- the decision problem we are modeling through a cost-effectiveness analysis

- dynamic patient uptake

- dynamic pricing

Decision problem we are modeling

We wish to evaluate the cost-effectiveness, measured as incremental cost per QALY, of a new intervention compared to the standard of care (SoC). The model is a partitioned survival analysis typical in oncology with three health states: progression-free (PF), progressive disease (PD) and death, with additional assumptions as follows:

- The time horizon is 20 years, a timestep is 1 week, discounting is at 3% per year, with an effective date of calculation is 2025-06-01.

- For SoC, progression-free survival (PFS) is modeled as an exponential distribution with mean of 50 weeks; overall survival (OS) in weeks is modelled according to a lognormal distribution with mean and standard deviation on the log scale as 4 and 1 respectively.

- The effect of the new intervention relative to the SoC is a hazard ratio of 0.5 on PFS and 0.6 on OS.

- Health utility is 0.8 in the PF state and 0.6 in the PD state.

- Drug acquisition costs are $400 and $1500 per week for SoC and the new intervention respectively, incurred throughout a patient’s time in the PF state (treat to progression).

- Drug administration costs are $50 and $75 per week on treatment for SoC and the new intervention respectively.

- Adverse events occur in 0.08% and 0.10% of SoC and new intervention patients per week respectively, while on treatment, at an average cost of $2000 per event.

- Disease management costs are $80 per week in PF and $20 per week in PD.

- Patients receive the treatment of interest (new or SoC) until progression. Subsequent treatment costs are $1200 and $300 per week per patient while in the PD state for SoC and new intervention patients respectively.

We code the time constants, time horizon, discount rates and inflation rates first.

# Time constants

days_in_year <- 365.25

days_in_week <- 7

cycle_years <- days_in_week / days_in_year # Duration of a one week cycle in years

# Time horizon (years) and number of cycles

thoz <- 20

Ncycles <- ceiling(thoz/cycle_years)

# Real discounting

disc_year <- 0.03 # Per year

disc_cycle <- (1+disc_year)^(cycle_years) - 1 # Per cycle

# Price inflation

infl_year <- 0.025 # Per year

infl_cycle <- (1+infl_year)^(cycle_years) - 1 # Per cycle

# Nominal discounting

nomdisc_year <- (1+disc_year)*(1+infl_year) - 1

nomdisc_cycle <- (1+nomdisc_year)^(cycle_years) - 1 # Per cycleThis model may then be coded in heemod as follows.

# State names

state_names = c(

progression_free = "PF",

progression = "PD",

death = "Death"

)

# PFS distribution for SoC with Exp() distribution and mean of 50 weeks

surv_pfs_soc <- heemod::define_surv_dist(

distribution = "exp",

rate = 1/50

)

# OS distribution for SoC with Lognorm() distribution, meanlog = 4.5, sdlog = 1

# This implies a mean of exp(4 + 0.5 * 1^2) = exp(4.5) = 90 weeks

surv_os_soc <- heemod::define_surv_dist(

distribution = "lnorm",

meanlog = 4,

sdlog = 1

)

# PFS and OS distributions for new

surv_pfs_new <- heemod::apply_hr(surv_pfs_soc, hr=0.5)

surv_os_new <- heemod::apply_hr(surv_os_soc, hr=0.6)

# Define partitioned survival model, soc

psm_soc <- heemod::define_part_surv(

pfs = surv_pfs_soc,

os = surv_os_soc,

terminal_state = FALSE,

state_names = state_names

)

# Define partitioned survival model, soc

psm_new <- heemod::define_part_surv(

pfs = surv_pfs_new,

os = surv_os_new,

terminal_state = FALSE,

state_names = state_names

)

# Parameters

params <- heemod::define_parameters(

# Discount rate

disc = disc_cycle,

# Disease management costs

cman_pf = 80,

cman_pd = 20,

# Drug acquisition costs - the SoC regime only uses SoC drug, the New regime only uses New drug

cdaq_soc = dispatch_strategy(

soc = 400,

new = 0

),

cdaq_new = dispatch_strategy(

soc = 0,

new = 1500

),

# Drug administration costs

cadmin = dispatch_strategy(

soc = 50,

new = 75

),

# Adverse event risks

risk_ae = dispatch_strategy(

soc = 0.08,

new = 0.1

),

# Adverse event average costs

uc_ae = 2000,

# Subsequent treatments

csubs = dispatch_strategy(

soc = 1200,

new = 300

),

# Health state utilities

u_pf = 0.8,

u_pd = 0.6,

)

# Define PF states

state_PF <- heemod::define_state(

# Costs for the state

cost_daq_soc = discount(cdaq_soc, disc_cycle),

cost_daq_new = discount(cdaq_new, disc_cycle),

cost_dadmin = discount(cadmin, disc_cycle),

cost_dman = discount(cman_pf, disc_cycle),

cost_ae = risk_ae * uc_ae,

cost_subs = 0,

cost_total = cost_daq_soc + cost_daq_new + cost_dadmin + cost_dman + cost_ae + cost_subs,

# Health utility, QALYs and life years

pf_year = discount(cycle_years, disc_cycle),

life_year = discount(cycle_years, disc_cycle),

qaly = discount(cycle_years * u_pf, disc_cycle)

)

# Define PD states

state_PD <- heemod::define_state(

# Costs for the state

cost_daq_soc = 0,

cost_daq_new = 0,

cost_dadmin = 0,

cost_dman = discount(cman_pd, disc_cycle),

cost_ae = 0,

cost_subs = discount(csubs, disc_cycle),

cost_total = cost_daq_soc + cost_daq_new + cost_dadmin + cost_dman + cost_ae + cost_subs,

# Health utility, QALYs and life years

pf_year = 0,

life_year = heemod::discount(cycle_years, disc_cycle),

qaly = heemod::discount(cycle_years * u_pd, disc_cycle)

)

# Define Death state

state_Death <- heemod::define_state(

# Costs are zero

cost_daq_soc = 0,

cost_daq_new = 0,

cost_dadmin = 0,

cost_dman = 0,

cost_ae = 0,

cost_subs = 0,

cost_total = cost_daq_soc + cost_daq_new + cost_dadmin + cost_dman + cost_ae + cost_subs,

# Health outcomes are zero

pf_year = 0,

life_year = 0,

qaly = 0,

)

# Define strategy for SoC

strat_soc <- heemod::define_strategy(

transition = psm_soc,

"PF" = state_PF,

"PD" = state_PD,

"Death" = state_Death

)

# Define strategy for new

strat_new <- heemod::define_strategy(

transition = psm_new,

"PF" = state_PF,

"PD" = state_PD,

"Death" = state_Death

)

# Create heemod model

heemodel <- heemod::run_model(

soc = strat_soc,

new = strat_new,

parameters = params,

cycles = Ncycles,

cost = cost_total,

effect = qaly,

init = c(1, 0, 0),

method = "life-table"

)Dynamic pricing

Let us suppose the following assumptions concerning pricing:

- Costs are assumed to increases in line with general inflation (2.5% per year), except for effects on drug acquisition costs due to LoEs.

- The date of calculation is 2025-09-01.

- The LoE for the SoC is assumed to occur first, at 2028-01-01, after which there is anticipated to be a 70% reduction in prices over one year.

- The new intervention has an LoE occuring three years later, at 2031-01-01, after which there would be a 50% reduction in prices over one year.

The assumptions can be codified as follows.

# Dates

# Date of calculation = 1 September 2025

doc <- lubridate::ymd("20250901")

# Date of LOE for SoC = 1 January 2028

loe_soc_start <- lubridate::ymd("20280101")

# Maturation of SoC prices by LOE + 1 year, i.e. = 1 January 2029

loe_soc_end <- lubridate::ymd("20290101")

# Date of LOE for new treatment = 1 January 2031

loe_new_start <- lubridate::ymd("20310101")

# Maturation of new treatment prices by LOE + 1 year, i.e. = 1 January 2032

loe_new_end <- lubridate::ymd("20320101")

# Effect of LoEs on prices once mature

loe_effect_soc <- 0.7

loe_effect_new <- 0.5

# Calculation of weeks since DoC for LoEs and price maturities

wk_start_soc <- floor((loe_soc_start-doc) / lubridate::dweeks(1))

wk_end_soc <- floor((loe_soc_end-doc) / lubridate::dweeks(1))

wk_start_new <- floor((loe_new_start-doc) / lubridate::dweeks(1))

wk_end_new <- floor((loe_new_end-doc) / lubridate::dweeks(1))

# Price maturity times

wk_mature_soc <- wk_end_soc - wk_start_soc

wk_mature_new <- wk_end_new - wk_start_new

# Create a tibble of price indices of length 2T, then pull out columns as needed

# We only need of length T for now, but need of length 2T for future calculations later

pricetib <- dplyr::tibble(

model_time = 1:(2*Ncycles),

model_year = model_time * cycle_years,

static = 1,

geninfl = (1 + infl_cycle)^(model_time - 1),

loef_soc = pmin(pmax(model_time - wk_start_soc, 0), wk_mature_soc) / wk_mature_soc,

loef_new = pmin(pmax(model_time - wk_start_new, 0), wk_mature_new) / wk_mature_new,

dyn_soc = geninfl * (1 - loe_effect_soc * loef_soc),

dyn_new = geninfl * (1 - loe_effect_new * loef_new)

)

# Price indices required for calculations

prices_oth <- pricetib$geninfl

prices_static <- pricetib$static

prices_dyn_soc <- pricetib$dyn_soc

prices_dyn_new <- pricetib$dyn_newDynamic patient uptake

Let us suppose the following assumptions concerning patient uptake. The aim here is to estimate the incidence of patients for whom the decision problem applies, i.e. the patients who would receive the new intervention, were it made available.

- Only newly incident patients with the cancer being modeled would be eligible for the new treatment. Existing/prevalent patients with the condition would not be eligible.

- The disease incidence is 1 patient per week.

- Among these patients, were the new intervention to be made available, uptake of the new intervention would be expected to rise linearly from 0% to 100% after 2 years.

In this way, uptake would be gradually increasing with time, accounting for disease epidemiology and the share of patients who receive the new intervention. The assumptions can be codified as follows.

# Time for uptake to occur

uptake_years <- 2

# Uptake vector for non-dynamic uptake

uptake_single <- c(1, rep(0, Ncycles-1))

# Uptake vector for dynamic uptake

uptake_weeks <- round(uptake_years / cycle_years)

share_multi <- c((1:uptake_weeks)/uptake_weeks, rep(1, Ncycles-uptake_weeks))

uptake_multi <- rep(1, Ncycles) * share_multiUsing dynamicpv

Without dynamic pricing or dynamic uptake

The conventional cost-effectiveness model is static.

heemodel

#> 2 strategies run for 1044 cycles.

#>

#> Initial state counts:

#>

#> PF = 1

#> PD = 0

#> Death = 0

#>

#> Counting method: 'life-table'.

#>

#> Values:

#>

#> cost_daq_soc cost_daq_new cost_dadmin cost_dman cost_ae cost_subs

#> soc 19455.25 0.0 2431.906 4601.624 8000.267 42634.43

#> new 0.00 141997.2 7099.860 8666.132 19999.582 16394.22

#> cost_total pf_year life_year qaly

#> soc 77123.47 0.9321475 1.613053 1.154261

#> new 194156.99 1.8142467 2.861562 2.079786

#>

#> Efficiency frontier:

#>

#> soc -> new

#>

#> Differences:

#>

#> Cost Diff. Effect Diff. ICER Ref.

#> new 117033.5 0.9255249 126451 socLet’s examine each payoff more closely. The next steps extract a payoff vector from the model object. The model/object contains several payoffs accumulated in each timestep, calculated as at time zero:

- drug acquisition cost of the standard of care (cost_daq_soc),

- drug acquisition cost of the new intervention (cost_daq_new),

- cost of drug administration (cost_dadmin),

- cost of disease management (cost_dman),

- cost of treating adverse events (cost_ae),

- cost of subsequent lines of treatment (cost_subs),

- total cost (cost_total),

- progression-free life years (pf_year),

- life years (life_year), and

- QALYs (qaly).

The dynamicpv::get_dynfields() function extracts these

parameters from the heemod model

object, and calculates ‘rolled-up’ values as at the start of each

timestep rather than discounted to time zero. The rolled-up values are

what dynamicpv::dynpv() requires.

# Pull out the payoffs of interest from oncpsm

payoffs <- get_dynfields(

heemodel = heemodel,

payoffs = c("cost_daq_new", "cost_daq_soc", "cost_total", "qaly", "life_year"),

discount = "disc"

) |>

dplyr::mutate(

model_years = model_time * cycle_years,

# Derive costs other than drug acquisition, as at time zero

cost_nondaq = cost_total - cost_daq_new - cost_daq_soc,

# ... and at the start of each timestep

cost_nondaq_rup = cost_total_rup - cost_daq_new_rup - cost_daq_soc_rup

)

# Create and view dataset for SoC

hemout_soc <- payoffs |> dplyr::filter(int=="soc")

head(hemout_soc)

#> # A tibble: 6 × 16

#> model_time cost_daq_new cost_daq_soc cost_total qaly life_year int vt

#> <int> <dbl> <dbl> <dbl> <dbl> <dbl> <chr> <dbl>

#> 1 1 0 396. 695. 0.0153 0.0192 soc 1

#> 2 2 0 388. 705. 0.0152 0.0191 soc 0.999

#> 3 3 0 380. 714. 0.0151 0.0191 soc 0.999

#> 4 4 0 372. 721. 0.0150 0.0191 soc 0.998

#> 5 5 0 365. 726. 0.0149 0.0190 soc 0.998

#> 6 6 0 357. 730. 0.0148 0.0189 soc 0.997

#> # ℹ 8 more variables: cost_daq_new_rup <dbl>, cost_daq_soc_rup <dbl>,

#> # cost_total_rup <dbl>, qaly_rup <dbl>, life_year_rup <dbl>,

#> # model_years <dbl>, cost_nondaq <dbl>, cost_nondaq_rup <dbl>

# Create and view dataset for new intervention

hemout_new <- payoffs |> dplyr::filter(int=="new")

head(hemout_new)

#> # A tibble: 6 × 16

#> model_time cost_daq_new cost_daq_soc cost_total qaly life_year int vt

#> <int> <dbl> <dbl> <dbl> <dbl> <dbl> <chr> <dbl>

#> 1 1 1493. 0 1847. 0.0153 0.0192 new 1

#> 2 2 1477. 0 1831. 0.0153 0.0192 new 0.999

#> 3 3 1461. 0 1815. 0.0152 0.0191 new 0.999

#> 4 4 1446. 0 1799. 0.0152 0.0191 new 0.998

#> 5 5 1431. 0 1783. 0.0151 0.0190 new 0.998

#> 6 6 1416. 0 1766. 0.0150 0.0190 new 0.997

#> # ℹ 8 more variables: cost_daq_new_rup <dbl>, cost_daq_soc_rup <dbl>,

#> # cost_total_rup <dbl>, qaly_rup <dbl>, life_year_rup <dbl>,

#> # model_years <dbl>, cost_nondaq <dbl>, cost_nondaq_rup <dbl>Scenario 1: No dynamic uptake or pricing

With non-dynamic uptake, we use

uptakes=uptake_single=1. Drug acquisition

costs are constant in real terms (prices=prices_static) and

are discounted at the risk-free real rate

(discrate=disc_cycle). Other costs rise in line with

general price inflation (prices=prices_oth) and are

discounted at nominal discount rates

(discrate=nomdisc_cycle). QALYs are not affected by price

inflation (prices=prices_static) and are discounted at the

risk-free real rate (discrate=disc_cycle).

# SOC

s1_soc_othcost <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_soc$cost_nondaq_rup,

prices = prices_oth,

discrate = nomdisc_cycle

)$results

s1_soc_daqcost <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_soc$cost_daq_soc_rup,

prices = prices_static,

discrate = disc_cycle

)$results

s1_soc_cost <- s1_soc_daqcost + s1_soc_othcost

s1_soc_qaly <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_soc$qaly_rup,

prices = prices_static,

discrate = disc_cycle

)$results

# New intervention

s1_new_othcost <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_new$cost_nondaq_rup,

prices = prices_oth,

discrate = nomdisc_cycle

)$results

s1_new_daqcost <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_new$cost_daq_new_rup,

prices = prices_static,

discrate = disc_cycle

)$results

s1_new_cost <- s1_new_daqcost + s1_new_othcost

s1_new_qaly <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_new$qaly_rup,

prices = prices_static,

discrate = disc_cycle

)$results

# Incrementals

s1_icost <- s1_new_cost@total - s1_soc_cost@total

s1_iqaly <- s1_new_qaly@total - s1_soc_qaly@total

s1_icer <- s1_icost / s1_iqalyThese results show that the new intervention is associated with $117,034 incremental costs relative to the standard of care (including $141,997 of drug acquisition costs for the new intervention) and 0.926 incremental QALYs. The cumulative ICER (incremental cost per QALY) is $126,451 per QALY at the 20 year time horizon.

Scenario 2: Dynamic pricing, no dynamic uptake

The costs of drug acquisition in each arm differ in Scenario 2

through applying the relevant dynamic price index

(prices_dyn_soc and prices_dyn_new), with

discounting at nominal rates (discrate = nomdisc_cycle).

Otherwise costs and QALYs are unchanged from Scenario 1.

# SOC

s2_soc_othcost <- s1_soc_othcost

s2_soc_daqcost <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_soc$cost_daq_soc_rup,

prices = prices_dyn_soc,

discrate = nomdisc_cycle

)$results

s2_soc_cost <- s2_soc_daqcost + s2_soc_othcost

s2_soc_qaly <- s1_soc_qaly

# New intervention

s2_new_othcost <- s1_new_othcost

s2_new_daqcost <- dynamicpv::dynpv(

uptakes = uptake_single,

payoffs = hemout_new$cost_daq_new_rup,

prices = prices_dyn_new,

discrate = nomdisc_cycle

)$results

s2_new_cost <- s2_new_daqcost + s2_new_othcost

s2_new_qaly <- s1_new_qaly

# Incrementals

s2_icost <- s2_new_cost@total - s2_soc_cost@total

s2_iqaly <- s2_new_qaly@total - s2_soc_qaly@total

s2_icer <- s2_icost / s2_iqalyUnder scenario 2, the new intervention has an incremental cost-effectiveness of $124,059 per QALY (incremental costs of $114,820, incremental QALYs of 0.926).

Scenario 3: Dynamic uptake, not dynamic pricing

The calculation for Scenario 3 is the same as for Scenario 1 except

for dynamic uptake, which is handled by setting

uptakes = uptake_multi.

# SOC

s3_soc_othcost <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_soc$cost_nondaq_rup,

prices = prices_oth,

discrate = nomdisc_cycle

)$results

s3_soc_daqcost <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_soc$cost_daq_soc_rup,

prices = prices_static,

discrate = disc_cycle

)$results

s3_soc_cost <- s3_soc_daqcost + s3_soc_othcost

s3_soc_qaly <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_soc$qaly_rup,

prices = prices_static,

discrate = disc_cycle

)$results

# New intervention

s3_new_othcost <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_new$cost_nondaq_rup,

prices = prices_oth,

discrate = nomdisc_cycle

)$results

s3_new_daqcost <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_new$cost_daq_new_rup,

prices = prices_static,

discrate = disc_cycle

)$results

s3_new_cost <- s3_new_daqcost + s3_new_othcost

s3_new_qaly <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_new$qaly_rup,

prices = prices_static,

discrate = disc_cycle

)$results

# Incrementals

s3_icost <- s3_new_cost@total - s3_soc_cost@total

s3_iqaly <- s3_new_qaly@total - s3_soc_qaly@total

s3_icer <- s3_icost / s3_iqalyUnder scenario 3, the new intervention has an incremental cost-effectiveness of $149,782 per QALY (incremental costs of $78,010,854, incremental QALYs of 521 from a cohort comprising 992 patients).

Scenario 4: Dynamic pricing and uptake

The costs of drug acquisition in each arm differ in Scenario 4 from

Scenario 3 through applying the relevant dynamic price index

(prices_dyn_soc and prices_dyn_new). Otherwise

costs and QALYs are unchanged from Scenario 3.

# SOC

s4_soc_othcost <- s3_soc_othcost

s4_soc_daqcost <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_soc$cost_daq_soc_rup,

prices = prices_dyn_soc,

discrate = nomdisc_cycle

)$results

s4_soc_cost <- s4_soc_daqcost + s4_soc_othcost

s4_soc_qaly <- s3_soc_qaly

# New intervention

s4_new_othcost <- s3_new_othcost

s4_new_daqcost <- dynamicpv::dynpv(

uptakes = uptake_multi,

payoffs = hemout_new$cost_daq_new_rup,

prices = prices_dyn_new,

discrate = nomdisc_cycle

)$results

s4_new_cost <- s4_new_daqcost + s4_new_othcost

s4_new_qaly <- s3_new_qaly

# Incrementals

s4_icost <- s4_new_cost@total - s4_soc_cost@total

s4_iqaly <- s4_new_qaly@total - s4_soc_qaly@total

s4_icer <- s4_icost / s4_iqalyUnder scenario 4, the new intervention has an incremental cost-effectiveness of $94,570 per QALY (incremental costs of $49,255,066, incremental QALYs of 521 from a cohort comprising 992 patients).

Summary of results

Total costs and QALYs for each scenario are summarized in the table below. The results above are skewed by the fact that some scenarios represent more than one patient cohort. Presenting results per patient, allows easier comparison between the scenarios.

| Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | ||

|---|---|---|---|---|---|

| Dynamic pricing? | No | Yes | No | Yes | |

| Dynamic uptake? | No | No | Yes | Yes | |

| Cohort size | 1 | 1 | 992 | 992 | |

| Total costs (cohort) | |||||

| New intervention | 194,157 | 191,248 | 129,401,743 | 91,698,157 | |

| Standard of care | 77,123 | 76,428 | 51,390,888 | 42,443,090 | |

| Incremental | 117,034 | 114,820 | 78,010,854 | 49,255,066 | |

| Total costs (per patient) | |||||

| New intervention | 194,157 | 191,248 | 130,380 | 92,391 | |

| Standard of care | 77,123 | 76,428 | 51,779 | 42,764 | |

| Incremental | 117,034 | 114,820 | 78,600 | 49,627 | |

| Total QALYs (cohort) | |||||

| New intervention | 2.08 | 2.08 | 1,309 | 1,309 | |

| Standard of care | 1.154 | 1.154 | 788 | 788 | |

| Incremental | 0.926 | 0.926 | 521 | 521 | |

| Total QALYs (per patient) | |||||

| New intervention | 2.08 | 2.08 | 1.319 | 1.319 | |

| Standard of care | 1.154 | 1.154 | 0.794 | 0.794 | |

| Incremental | 0.926 | 0.926 | 0.525 | 0.525 | |

| ICER | 126,451 | 124,059 | 149,782 | 94,570 |

Future single cohort ICER

The table above presents the cost-effectiveness results as of the

date of calculation, 2025-09-01. However, it is interesting to explore

how the ICER will change over time, given the expected evolution of

prices. We use dynamicpv::futurepv() to calculate present

values at future times. This function is a wrapper for

dynamicpv::dynpv(). This is the single cohort ICER (no

dynamic uptake) but with dynamic pricing, so corresponds with Scenario 2

from earlier.

First, we calculate the costs at each time of interest. Then we calculate the ICER, given the incremental QALYs we have already observed - and which are immune from pricing effects.

# Times at which to plot ICER

gtimes <- round((0:(2*thoz))/cycle_years/2)

# SOC drug acquisition costs

gc_soc_daq <- gtimes |>

purrr::map_vec(\(l) dynamicpv::futurepv(

tzero = l,

payoffs = hemout_soc$cost_daq_soc_rup,

prices = prices_dyn_soc,

discrate = nomdisc_cycle

)$pv

)

# SOC other costs

gc_soc_oth <- gtimes |>

purrr::map_vec(\(l) dynamicpv::futurepv(

tzero = l,

payoffs = hemout_soc$cost_nondaq_rup,

prices = prices_oth,

discrate = nomdisc_cycle

)$pv

)

# New drug acquisition costs

gc_new_daq <- gtimes |>

purrr::map_vec(\(l) dynamicpv::futurepv(

tzero = l,

payoffs = hemout_new$cost_daq_new_rup,

prices = prices_dyn_new,

discrate = nomdisc_cycle

)$pv

)

# New other costs

gc_new_oth <- gtimes |>

purrr::map_vec(\(l) dynamicpv::futurepv(

tzero = l,

payoffs = hemout_new$cost_nondaq_rup,

prices = prices_oth,

discrate = nomdisc_cycle

)$pv

)

# Combine in a tibble

ds <- dplyr::tibble(

# Time in weeks and years

time_weeks = gtimes,

time_years = time_weeks * cycle_years,

# Evaluation date

evaldate = doc + time_weeks * 7,

# Price/inflation index

pinfl = prices_oth[gtimes + 1],

# Total costs for each intervention

totcost_new = gc_new_daq + gc_new_oth,

totcost_soc = gc_soc_daq + gc_soc_oth,

# Scenario 1/2 QALYs

qaly_soc = s1_soc_qaly@total,

qaly_new = s1_new_qaly@total

) |>

dplyr::mutate(

# Incremental cost and QALYs

icost = totcost_new-totcost_soc,

iqaly = qaly_new-qaly_soc,

# Nominal ICER, and real (inflation adjusted) ICER

Nominal = icost/iqaly,

Real = Nominal / pinfl

) |>

# Pivot to long so can be used in a graphic

tidyr::pivot_longer(

cols = c("Nominal", "Real"),

names_to = "Type",

values_to = "ICER"

)We should check at this point that the ICER we are starting at ($124,059) matches the scenario 2 ICER from earlier ($124,059).

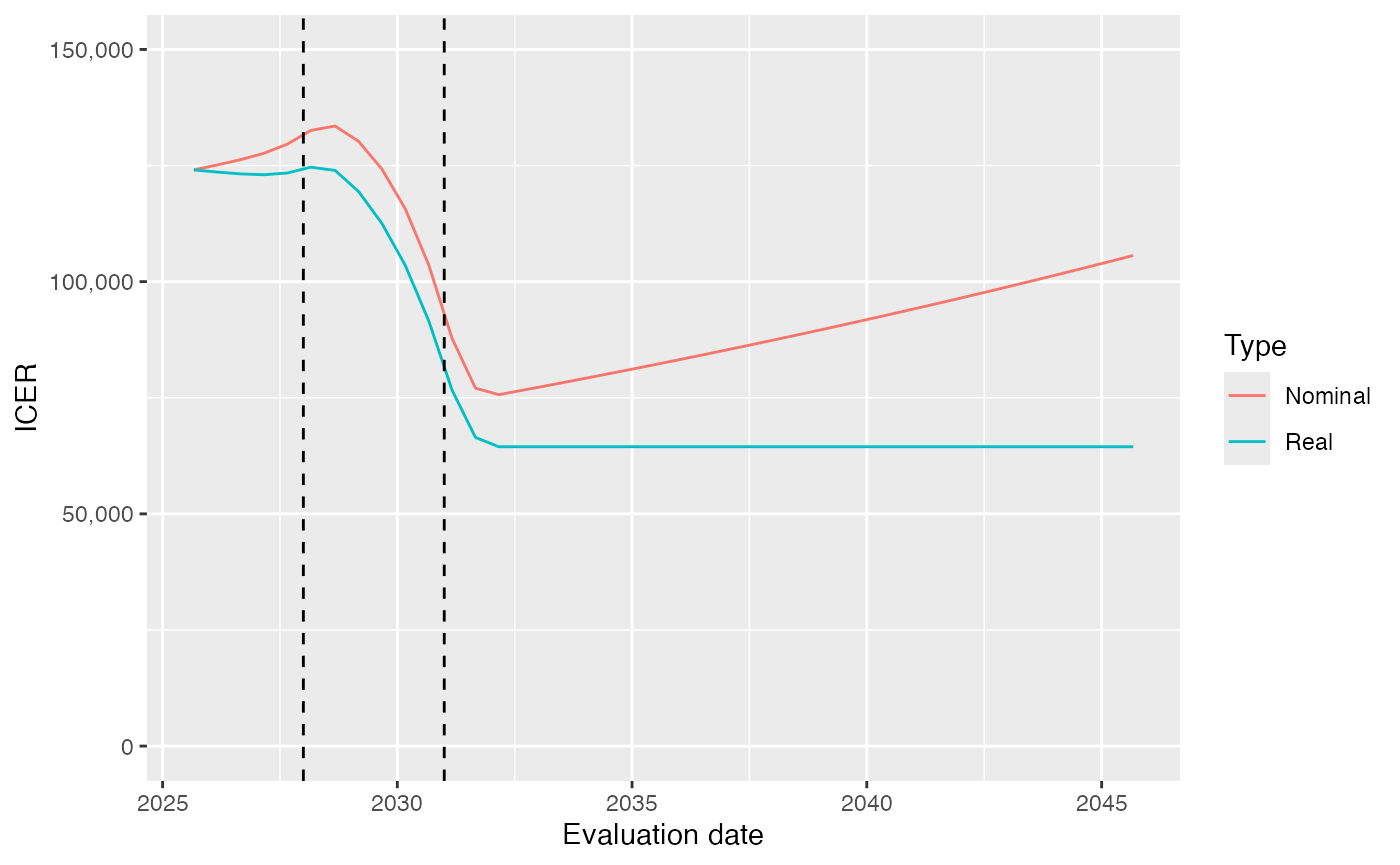

The following plot shows the nominal ICER calculated at different times, given the pricing, LoE and other assumptions. The horizontal dotted line confirms that the initial ICER matches the value from Scenario 2. The vertical dashed lines mark the timings of the LoEs of first the standard of care, and then the new treatment.

# Plot real and nominal present value over time

ggplot2::ggplot(ds,

aes(x = evaldate, y = ICER, color=Type)) +

geom_line() +

labs(x = "Evaluation date") +

geom_hline(yintercept = ds$ICER[1], linetype='dotted') +

geom_vline(xintercept = loe_new_start, linetype='dashed') +

geom_vline(xintercept = loe_soc_start, linetype='dashed') +

scale_y_continuous(

labels = scales::comma,

limits=c(0, 150000)

)

Discussion

The findings for this example model are as follows:

The effect of assuming dynamic pricing rather than flat pricing over time is shown in the difference between results of scenarios 1 and 2. Scenario 1 assumed no increases in drug acquisition costs, but inflationary increases in other costs. Scenario 2 additionally assumed drug prices of the new intervention and SoC comparator would be eroded due to losses of exclusivity. This has a material impact on costs per patient of the new intervention (reducing from $194,157 to $191,248). Accordingly the ICER reduces from $126,451 to $124,059 per QALY.

The effect of modeling uptake dynamically rather than just the current cohort of patients is shown in the difference between results of scenarios 1 and 3. Dynamic modeling of uptake has the effect of weighting the costs and QALYs per patient in scenario 3 towards a later cohort of patients, where the accumulation of costs and QALYs over the time remaining in the payer’s 20 year time horizon will be less. The incremental costs per patient reduced from $194,157 in scenario 1 to $130,380 in scenario 3, whereas the incremental QALYs reduced from 2.08 to 1.319 per patient. Overall, the ICER increased slightly from $126,451 to $149,782 per QALY.

The effects of dynamic pricing and dynamic uptake are extremely synergistic. Scenario 4 illustrates the effects of both dynamic pricing and cohort modeling. The results per patient are identical to scenario 3, except that the cost per patient of the new intervention reduces from $130,380 to $92,391, due to the impact of dynamic pricing. The ICER in this case is reduced considerably to $94,570 per QALY.

As shown in the Figure, the ICER increases a little at first, as we approach the LoE of the standard of care comparator. After all, a cheaper comparator will increase the incremental cost of the new treatment. However, this is soon dwarfed by the effect of the LoE of the new treatment, which occurs later. This reduces the ICER significantly as the LoE approaches. Thereafter, the ICER is constant in real terms (but increasing with price inflation in nominal terms).